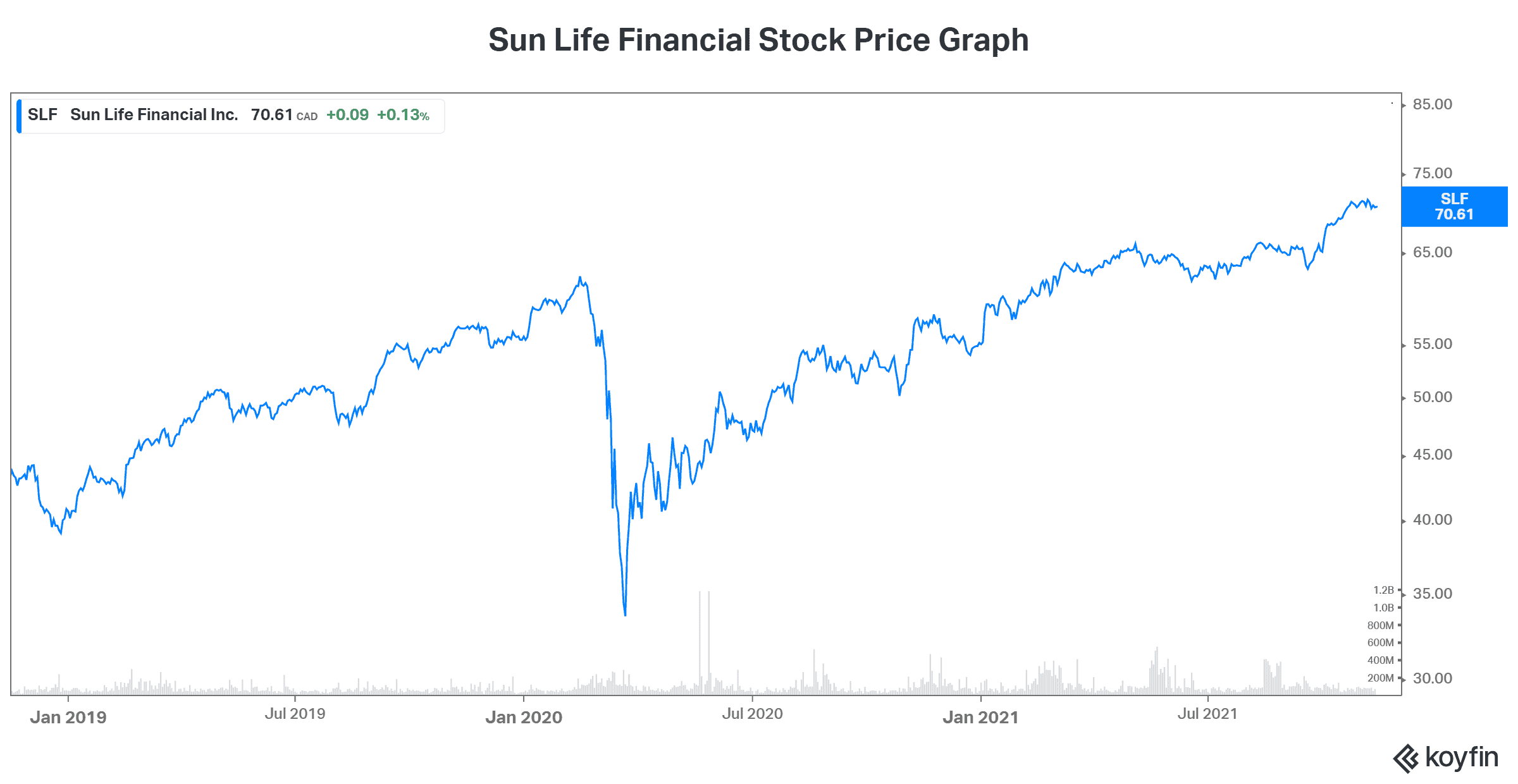

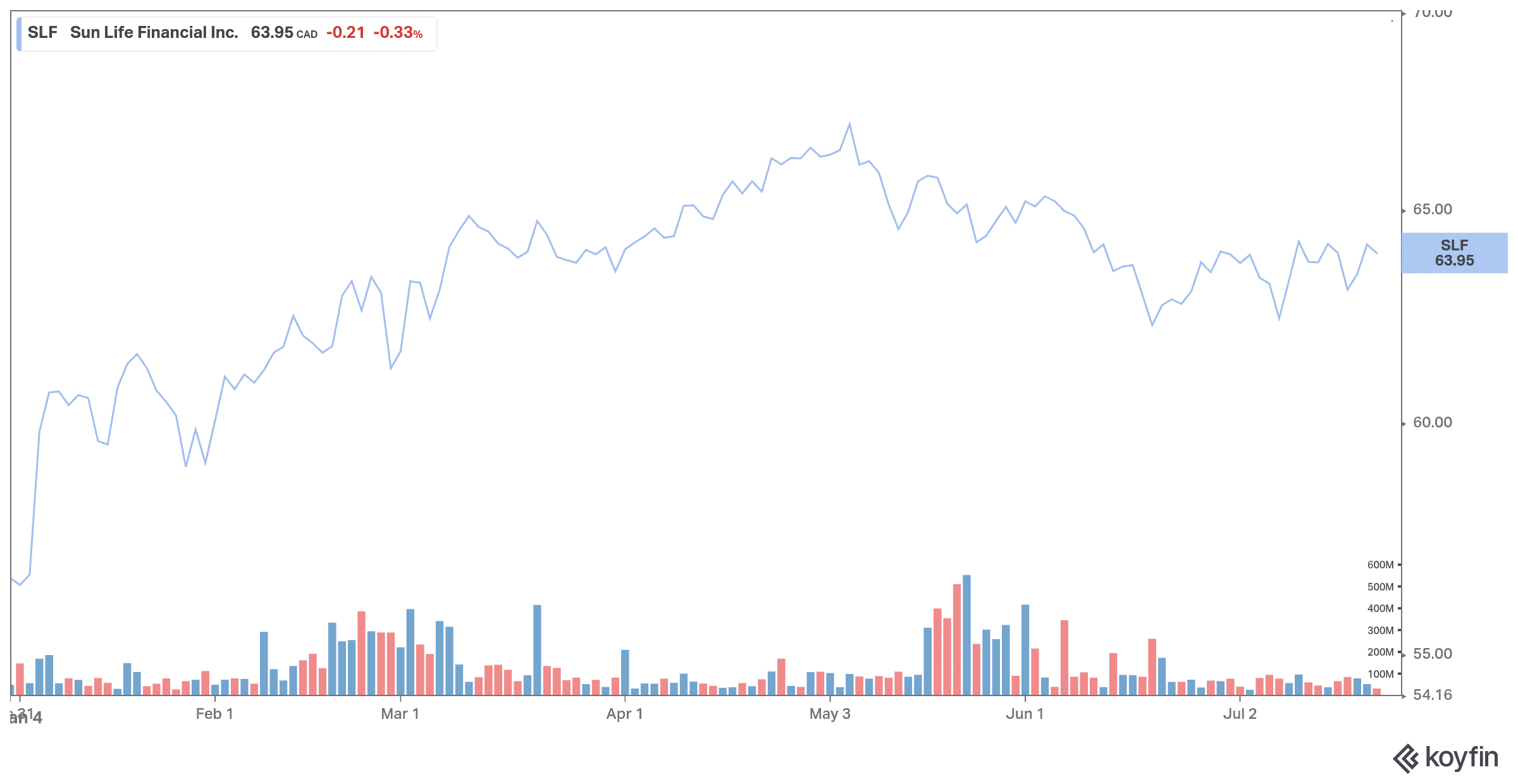

Kinsale Capital delivered earnings surprise of 20.00% in the last reported quarter.įidelity National delivered earnings surprise of 53.52% in the last reported quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.ĭonegal Group delivered earnings surprise of 134.62% in the last reported quarter. Some other top-ranked companies in the insurance industry are Donegal Group DGICA, Kinsale Capital Group KNSL and Fidelity National Financial FNF, each sporting Zacks Rank #1. Shares of Sun Life Financial have lost 6.9% year to date, narrower than the industry's decline of 18.2%. The company expects dividend payout ratio of 40-50% of earnings over the medium term. Its stable cash flow profile supports an attractive annual dividend, yielding 3.7%, and betters the industry average of 3.4%, making this an attractive pick for yield-seeking investors. Sun Life Financial had a strong capital and cash position along with a low leverage ratio of 23.2% at the end of the second quarter (below its target of 25%).

This Zacks Rank #2 (Buy) life insurer aims underlying earnings per share growth of 8-10% per annum over the medium term. The company currently has $1.1 trillion assets under management. Sun Life is aggressively trying to grow its Global Asset Management Business, which has been witnessing a rise in asset base for the past many quarters. It also acquired a majority stake in InfraRed Capital Partners to broaden management suite of alternative investment solutions. To that end, it is in advanced talks to acquire Crescent Capital Group, the $28-billion worth credit manager per reliable sources. Recently, the company expressed its willingness to make an acquisition in the low investment grade private credit space.

Strategic buyouts continue to drive growth. It is shifting its growth focus toward products that park lower capital and offer more predictable earnings. The company continues to make strategic investments in Asia to retain the momentum. The third largest insurer in Canada remains focused on the emerging economies that are expected to provide higher return and growth than the North American markets.

The company estimates generating underlying ROE of 12-14% over the medium term. Return on equity of 13.8% in the trailing 12 months was better than the industry average of 11.4%, reflecting the company’s efficiency in utilizing shareholders’ funds. The Zacks Consensus Estimate for 20 earnings has moved up 5.5% and 5.3%, respectively in the past 30 days, reflecting analysts’ optimism. The company currently carries an impressive VGM Score of B.

Sun Life Financial SLF is well-poised for growth, riding on strong Asian presence, expanding global asset management and a sturdy financial position.

0 kommentar(er)

0 kommentar(er)